Businesses today are under constant pressure to streamline operations and boost their bottom line. That’s why we’re seeing such a surge in companies outsourcing their accounting. The numbers are growing – the global market for finance and accounting outsourcing services is projected to hit $75.2 billion by 2030.

And when you talk about accounting outsourcing, one place keeps popping up: the Philippines. It’s interesting because they’re facing a shortage of accountants at home. Fewer students are choosing accounting as a career, but the Philippines remains a top choice for companies looking to outsource their accounting operations. You’ll find top accounting outsourcing service providers in the Philippines. But why?

What makes accounting services in the Philippines so sought-after and reliable? And how much does outsourced accounting cost? Read on to find the answers to these questions and see how accounting outsourcing in the Philippines can ultimately benefit your business.

Outsourced Accounting: An Overview

For you to understand how much outsourced accounting costs and how reliable it is, let’s first answer the question: What is outsourced accounting?

Simply put, outsourced accounting means handing your books to a specialised partner so you can stay focused on product and growth. Tasks such as bookkeeping, tax prep, and payroll shift to their desk, not yours.

The move frees your team to zero in on core work, while trained finance pros manage every ledger and return. With cloud tools and a global talent pool, this model has become the preferred route for firms aiming to lower costs and increase efficiency.

Reliability of Accounting Outsourcing in the Philippines

With excellent English skills, Filipino accounting professionals can easily communicate and work with clients from all over the world. Many of them hold certifications that prove offshore accountants in the Philippines are well-acquainted with global accounting practises and standards, making them incredibly valuable to businesses everywhere. Here are some of the certifications that many accountants in the Philippines hold:

- CPA (Certified Public Accountant)

- CMA (Certified Management Accountant)

- ACCA (Association of Chartered Certified Accountants)

Companies like All In Outsourcing are a prime example of what the Philippine outsourcing industry has to offer. Our team of experienced accounting professionals, strong data security measures, and diverse global client base show how businesses can confidently outsource their accounting to the Philippines without sacrificing quality or security. In a nutshell, accountants in the Philippines are talented and hold a high commitment to international standards.

Security Measures in Philippine Accounting Outsourcing

When thinking about finding outsourced accountants from the Philippines, one of the first things on your mind is probably data security. It’s a valid concern, and thankfully, the Philippines takes it seriously.

Accounting firms in the Philippines aim for ISO 27001 certification. This is a big deal internationally, showing they’re committed to information security best practises. Think of it as a gold standard, covering everything from risk assessment to data protection.

Locally, the Philippines has its own Data Privacy Act (Republic Act No. 10173). This law sets strict data protection rules for everyone, both in government and private sectors. It’s designed to mirror international data protection principles – keeping your personal information safe from prying eyes and unauthorised use.

On the tech side, accounting outsourcing firms use sophisticated cybersecurity measures. They often rely on secure cloud-based accounting software like QuickBooks, Xero, and SAP, which have built-in encryption and access controls.

So, when you add it all up—the certifications, the legal framework, and the tech–accounting outsourcing firms in the Philippines offer a pretty secure place for your financial data. That should give you peace of mind to focus on what you do best: running your business.

Cost-Effectiveness of Outsourced Accounting in the Philippines

Now, we answer the big question: How much does outsourced accounting cost in the Philippines? One of the biggest draws of outsourcing accounting to the Philippines is the potential for significant cost savings.

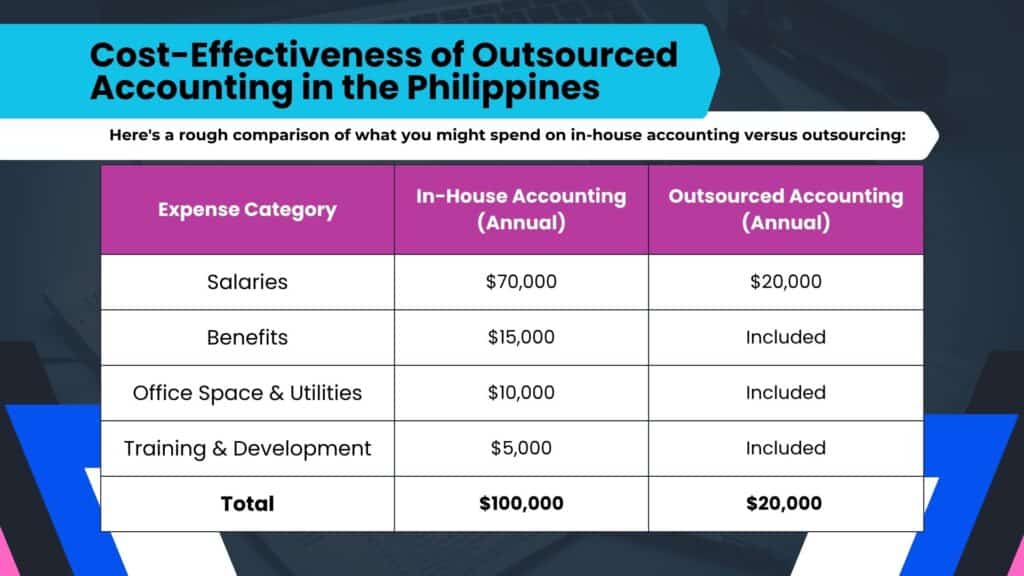

You can often save a bundle compared to keeping everything in-house. This is mainly because salaries and overhead costs are generally lower in the Philippines. To give you a clearer picture, here’s a rough comparison of what you might spend on in-house accounting versus outsourcing:

Note: The figures above are illustrative and may vary based on specific circumstances.

But it’s not just about saving money. Outsourcing to the Philippines can also make your operations run more smoothly. The time difference, for example, can be a plus. It can allow for nearly around-the-clock operations, which means faster turnaround times and a continuous workflow.

Another benefit is scalability. Good outsourcing companies in the Philippines can adapt to your changing needs. Whether you’re ramping up during busy periods or things are slowing down, they can adjust their resources to match your workload.

Choosing the Right Accounting Outsourcing Partner

A good, experienced outsourcing company can save you money, sure, but more importantly, they give you peace of mind. So, before you jump in and outsource, it’s essential to look at a few key things:

1. Look for ISO-certified firms

When you’re looking for a reliable accounting firm to outsource to, one of the first things you should check is whether they have certain ISO certifications. These certifications are a sign that the firm takes security and quality seriously:

- ISO 27001 – A guarantee that your sensitive financial data is in safe hands. This certification means the firm follows strict rules for information security, including things like data protection, risk management, and regular security checks.

- ISO 9001 – This certification focuses on quality management, which means the firm has well-defined processes and is always looking for ways to improve.

These certifications give you peace of mind that the outsourcing firm operates at a high standard, so you can trust them with your important accounting needs.

2. Check strong client reviews or testimonials

When choosing an outsourcing partner, it’s crucial to get a sense of their track record. What better way to do that than by checking out what their past clients have to say? Look for reviews, testimonials, and case studies. Happy clients are a great indicator of a reliable, efficient, and high-quality service provider.

It’s especially helpful to find testimonials from businesses similar to yours. This gives you a clearer picture of how the outsourcing firm handles challenges specific to your industry.

For example, All In Outsourcing has earned a solid reputation by consistently providing top accounting services to a wide range of clients across the globe. Their commitment to performance and customer service has helped them build trust in the industry.

3. Ensure they offer customised accounting solutions

No two businesses are exactly alike, so why should their accounting be? When you’re looking to outsource your accounting, you need a partner who gets your business. They should be able to tailor their services to fit your specific industry and needs.

Think about it: an online store has very different accounting challenges than a doctor’s office. E-commerce companies are wrestling with tons of transactions and tricky sales tax issues. Healthcare providers need to be super precise with patient billing and insurance claims. And financial firms? They’re dealing with strict regulations and complex reporting requirements.

The right outsourcing partner will understand these nuances. They’ll offer flexible, scalable solutions that work with your current systems and help you reach your goals.

4. Check for experience handling international financial regulations

When you’re dealing with money across borders, you need to know the rules of the game in every country. It’s crucial that any outsourcing partner you consider has a solid track record with international finance:

- US GAAP (Generally Accepted Accounting Principles) for businesses operating in the United States.

- IFRS (International Financial Reporting Standards) is used in many countries worldwide.

- Regional tax laws to ensure compliance with local tax authorities.

Here’s a good thing to look for: Philippine outsourcing firms often make a point of keeping their accountants’ skills sharp with ongoing training in global accounting practises. Many Filipino finance professionals also hold certifications. These credentials tell you they’re serious about their profession and capable of handling complex financial matters, no matter where your business is.

Final Takeaways

Accounting outsourcing in the Philippines offers a compelling blend of reliability, security, and cost-effectiveness, making it an ideal solution for businesses aiming to optimise their operations.

With highly skilled professionals holding certifications like CPA, CMA, and ACCA, alongside robust security measures such as ISO 27001 certification and compliance with the Data Privacy Act, the Philippines stands out as a trusted hub for accounting services. Addressing the key question—how much does outsourced accounting cost?—the potential savings are significant, all while maintaining quality and scalability.

By choosing the right partner, businesses can leverage tailored solutions, global expertise, and strong client trust to drive efficiency and growth. Ready to explore the benefits for your business? Connect with All In Outsourcing today to discover how our team can transform your accounting operations with precision and value.